The UK Government publishes its latest research into the fast-growing UK Artificial Intelligence sector.

The UK Government’s Department for Science, Innovation and Technology, has published its latest sector research highlighting the rapid growth of the UK’s Artificial Intelligence sector. As one of the UK’s Industrial Strategy “frontier sectors”, AI is driving innovation, attracting investment, creating jobs, and strengthening the economy.

Our AI research capability played a key role in deep-reading the web and official sources to identify the AI developers and AI diversified companies across the UK, helping to showcase the strength and breadth of this thriving ecosystem. The capability also provided the key insights about the products and services offered by the AI companies.

Glass.AI has provided the necessary evidence for this annual analysis of the UK’s AI sector since 2022, contributing to the UK Government estimates of the scale, scope and growth of firms developing AI products and services. You can find here more details about our Agentic AI approach to automating sector and place research for Governments.

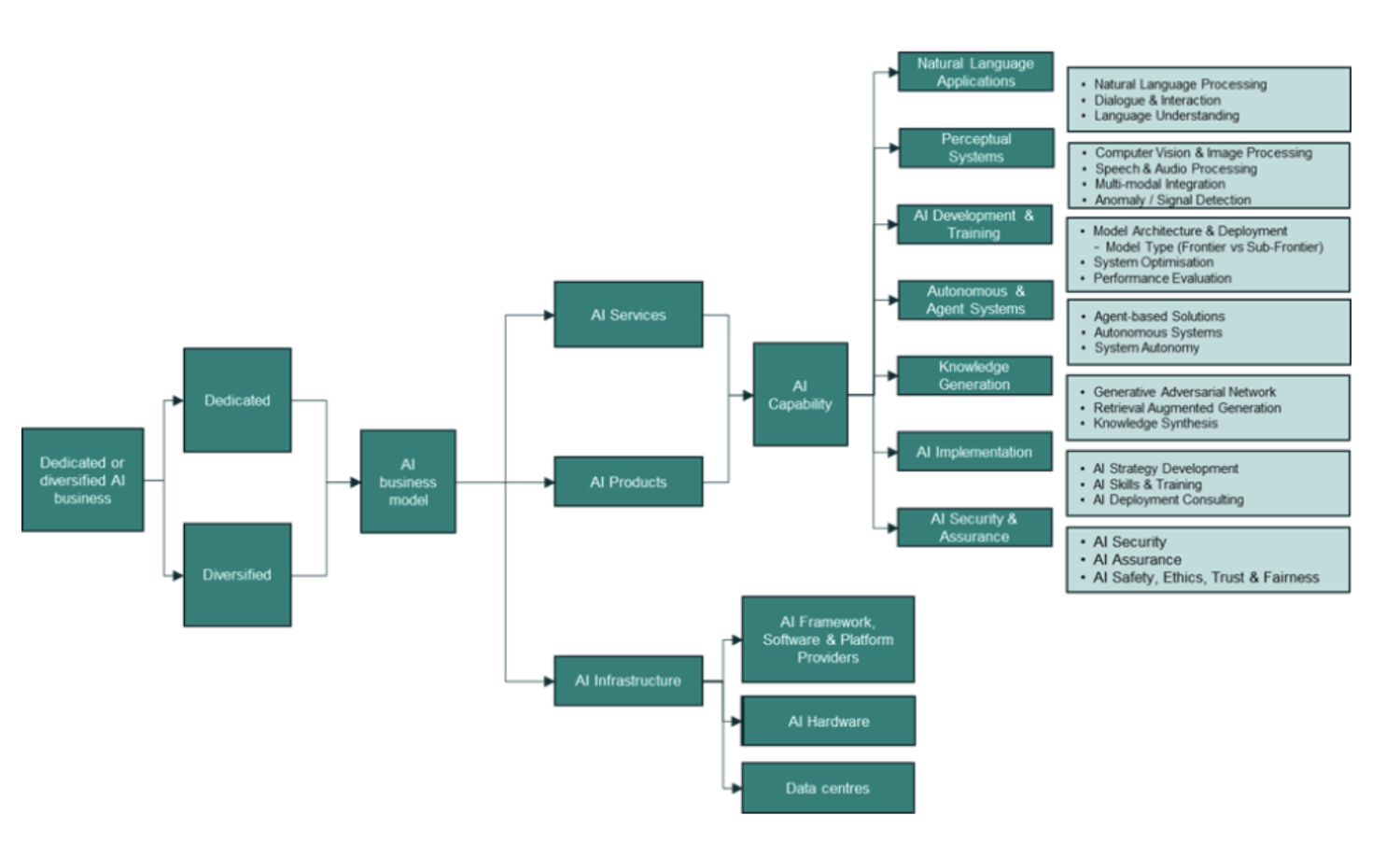

Like in previous studies, given that Standard Industrial Classification (SIC) codes do not yet include a specific ‘artificial intelligence’ classification, the analyses contained in this report were based on a business-focused taxonomy that can better reflect AI activity in the UK. The taxonomy used to describe AI activity in this study is illustrated below:

Key insights

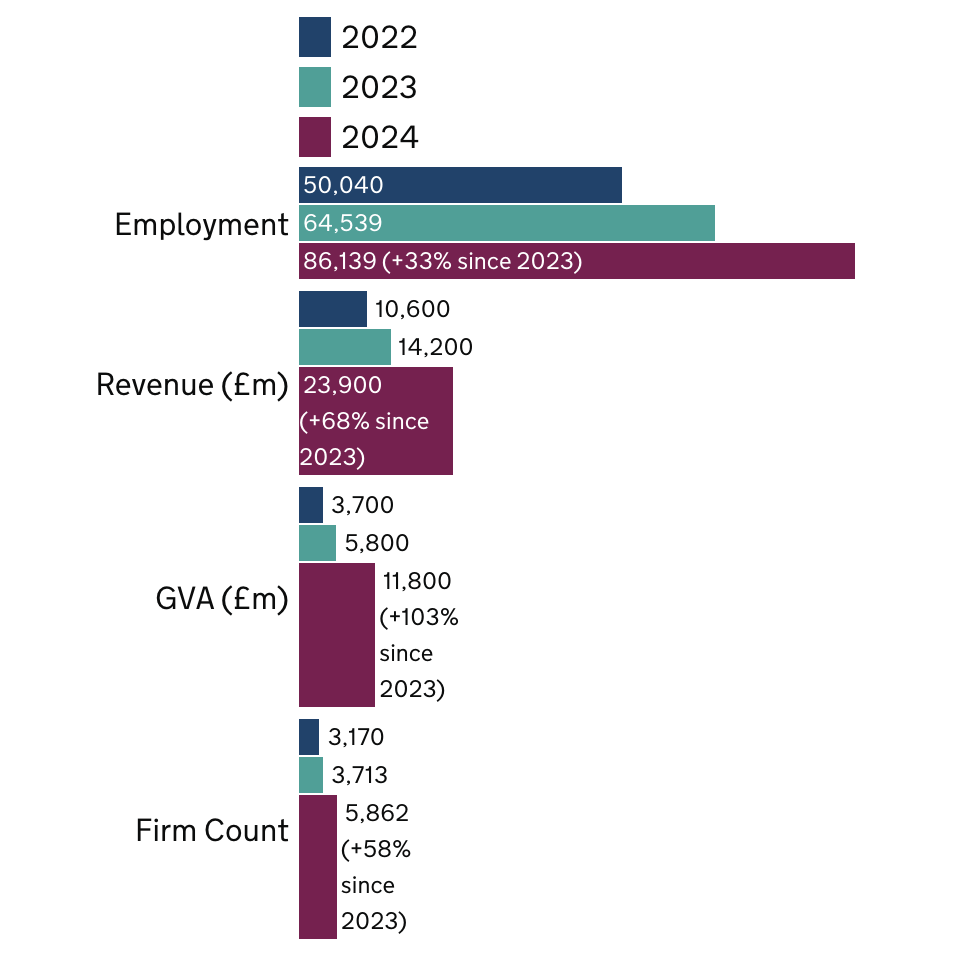

Companies: From 2023 to 2024, the number of AI firms jumped by 58% to around 5,800.

Employment: UK AI sector employment grew by 33% to around 86,000.

Revenue: Revenue saw a massive increase of 68%, reaching around £23.9 billion.

Gross Value Added (GVA): The sector’s GVA more than doubled, increasing by 103% to £11.8 billion.

Investment: Investment in dedicated AI companies rebounded to £2.9 billion, surpassing the previous 2022 record.

Conclusion

The UK’s artificial intelligence sector has grown substantially over the past year across all core economic metrics. This increase in AI companies since 2023, driven by SMEs and micro-businesses, reflects widespread recognition of AI-enabled business opportunities across diverse economic sectors. A potential next step in this research to fully understand the size of the sector would involve looking at the adoption of AI.

You can read the full UK AI report here.

At Glass.AI, we are supporting many governments to understand and monitor their key emerging sectors, including the EU Commission, the Australian Government and others.

If you’re interested in tracking one of these ‘impossible’ sectors in the UK or globally, please contact us at info@glass.ai.